Signing on the dotted line screams huge dedication for a purchaser and excellent news for a vendor.

The quantity of offers a enterprise can efficiently shut is clearly a key worth to measure for B2B corporations. It signifies that your gross sales workforce effectively reels in helpful clients, earns their belief, and will get them to purchase your resolution.

However what concerning the typical worth behind these closed-won offers? When a contract is signed, how do you assess the monetary impression on your online business? That is the place annual contract worth (ACV) comes into play, serving to you perceive what to anticipate from every contract.

Use a gross sales efficiency administration software to watch your gross sales progress and course appropriate.

What’s annual contract worth?

Annual contract worth (ACV) is the typical annual income generated from every buyer contract, excluding any one-time charges. It is primarily utilized by software-as-a-service (SaaS) corporations that supply options by way of annual or multi-year subscription plans.

Measuring ACV by itself doesn’t supply that a lot worth to companies. It’s mostly in contrast in opposition to different gross sales metrics which might be associated to bills, like buyer acquisition value (CAC). When you examine ACV and CAC, you may see what number of contracts must be signed to generate sufficient income to cowl the price of buying clients.

Easy methods to calculate ACV

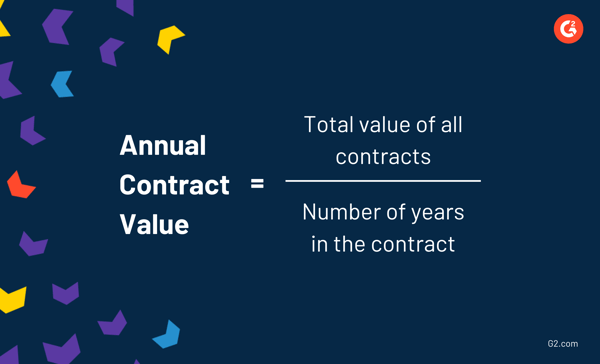

Annual contract worth contains the worth of all income from subscriptions normalized throughout one 12 months. To calculate your ACV, take the full worth of your whole contracts and divide that quantity by the full variety of years within the contract. The ACV method is as follows:

Extra ACV components

Sadly for these in search of good consistency in each gross sales metric, ACV doesn’t present that. Every enterprise might need their very own particular person methodology of calculating ACV.

Some may use the fundamental equation given above, however others may take the next values into consideration:

- One-time charges: Issues like coaching, onboarding, and implementation charges additionally generate income for a enterprise, so some may embrace it of their ACV calculation. Since these charges are solely paid as soon as within the first 12 months of the contract, the ACV for companies that take these charges into consideration can be larger in 12 months 1 than in 12 months 2, 3, and so forth.

- Enlargement: Buying new clients may end up in the revenue you acquire from them rising over time by way of up-selling and cross-selling strategies.

- Churn: The lack of current clients devalues your funding of buying them.

Calculating annual contract worth: examples

With that method in thoughts, let’s take a look at an instance of the right way to calculate ACV with each a short-term and long-term buyer.

Your long-term buyer, Pretend Firm 500, has signed a 5-year contract with your online business price $125,000. Pretend Firm 500 pays an annual charge to your resolution. The ACV for Pretend Firm 500 could be $25,000 per 12 months.

$125,000 / 5 years = $25,000 per 12 months

Say you’ve gotten one other buyer, Actual Firm ABC, that’s extra occupied with a brief time period dedication. They signed a 6-month contract price $4,000 and can be making funds month-to-month. Since ACV is averaged over the 12 months, versus the size of the contract, the ACV for Actual Firm ABC is $4,000 per 12 months.

$4,000 / 6 months = $4,000 per 12 months

One of the simplest ways to search out your ACV throughout all present buyer accounts is to take action whereas evaluating it to annual recurring income, which can be mentioned subsequent.

Why is ACV essential?

As a result of it’s merely an extra methodology for representing income not directly or one other, common contract worth isn’t that nice of an perception standing alone. Companies measure ACV to see how they’re performing in different key areas – a well-liked one being CAC.

CAC is the price related to convincing somebody to buy your resolution. Evaluating revenue-adjacent values in opposition to CAC is an efficient approach to measure the profitability of a enterprise. For instance, companies will examine CAC to buyer lifetime worth (CLV) and decide if the worth of a long-term relationship with a buyer is sufficient to account for the price of buying them.

The comparability of ACV and CAC asks the query: “What number of offers do I want to shut to cowl my buyer acquisition value?”

As a result of ACV is averaged throughout all present subscriptions, it affords perception into what number of offers a enterprise wants to shut to make a sure amount of cash. Companies will take a look at CAC and decide what number of offers they should near cowl it (based mostly on ACV).

For the explanation acknowledged above, ACV can be used when setting income objectives. Companies will take annual contract worth and conversion price into consideration when forecasting income for a sure time interval.

For instance, in case your ACV is $10,000 and your gross sales workforce hovers round 4 offers 1 / 4, you may challenge that your online business will generate an estimated $40,000 in income that quarter.

Tip: Buying new clients is hard, and also you don’t need to waste cash attempting to reel in individuals who aren’t even . G2’s Purchaser Intent Information can present you the businesses researching your online business, so you may attain out to the precise individual on the proper time.

Annual contract worth and different SaaS metrics

Along with ACV, there are different key subscription metrics within the SaaS house that assist companies perceive their income streams and progress potential. Let’s dive into annual recurring income (ARR) and whole contract worth (TCV), and see how they complement ACV to provide a full monetary image.

ACV vs ARR

Annual contract worth and annual recurring income are seen as cousins within the gross sales world. As a result of the definitions are so related and the values can typically mirror one another, annual contract worth and annual recurring income are sometimes confused for each other. Let’s set the file straight.

ACV is the typical amount of cash being generated from subscription-based actions for that 12 months. ARR is the worth of recurring income of a enterprise’ subscriptions for a single calendar 12 months. Primarily, it’s the yearly earnings from one subscription.

When just one buyer’s ARR and ACV are being measured, they’re usually the identical worth – the amount of cash {that a} enterprise will make from that buyer for the 12 months. Issues get a bit extra complicated when taking a look at whole ACV vs ARR.

ACV vs ARR instance

One of the simplest ways to indicate an instance of ACV and ARR is to work with a number of clients and measure values over a number of years.

Let’s break it down by buyer after which present the mixed whole ACV and ARR for this enterprise, utilizing Pretend Firm 500 once more.

Buyer A agrees to a $2,000 contract for one 12 months. They are going to pay Pretend Firm 500 yearly. Because the worth of the contract is $2,000 and the variety of years within the contract is one, ACV is $2,000. As a result of Pretend Firm 500 can be receiving $2,000 in income for the 12 months from that buyer, ARR is $2,000.

ACV: $2,000

ARR: $2,000

Buyer B agrees to a $1,600 contract for 2 years. They are going to pay Pretend Firm 500 yearly. Because the whole worth of the contract is $1,600 and the full variety of years within the contract is 2, ACV is $800. As a result of Pretend Firm 500 can be receiving $1,600 in income throughout two years, ARR can be $800.

ACV: $800

ARR: $800

Buyer C agrees to a $1,200 contract for 3 years. They pay Pretend Firm 500 yearly. Because the whole worth of the contract is $1,200 and the full variety of years within the contract is three, ACV is $400. As a result of Pretend Firm 500 can be receiving $1,200 in income throughout three years, ARR can be $400.

ACV: $400

ARR: $400

Now, that may not appear to be a lot and also you is likely to be a bit confused. Bear with me! As soon as we do a closing calculation for the 12 months that takes all three clients into consideration, the distinction between ACV and ARR will make much more sense.

ARR instance

Let’s begin with ARR. To calculate ARR, merely add the worth from every contract that Pretend Firm 500 can be receiving that 12 months.

In 12 months 1, Pretend Firm 500 will obtain $2,000 from Buyer A, $800 from Buyer B, and $400 from Buyer C, leading to $3,200 in annual recurring income.

$2000 + $800 + $400 = $3,200

On the finish of 12 months 1, Buyer A’s contract has ended, in order that they’ll now not be paying a subscription. In 12 months 2, Pretend Firm 500 can anticipate one other $800 from Buyer B and $400 from Buyer C. Their ARR for 12 months 2 could be $1,200.

$800 + $400 = $1,200

In 12 months 3, Buyer C is the one one remaining with a contract. Since they pay $400 a 12 months, the ARR for Pretend Firm 500 could be $400 for 12 months 3.

ACV instance

Now let’s check out ACV.

In 12 months 1, Pretend Firm 500 will generate $2,000 in income from Buyer A, $800 from Buyer B, and $400 from Buyer C. There are three contracts in query, so Pretend Firm 500’s ACV for 12 months 1 is $1,067.

$2,000 + $800 + $400 = $3,200 / 3 = $1,067 per 12 months

In 12 months 2, similar to with ARR, Pretend Firm 500 will solely be producing income from Buyer B, who pays $800, and Buyer C, who pays $400. The ACV for 12 months 2 could be $600.

$800 + $500 = $1,200 / 2 = $600 per 12 months

In 12 months 3, Pretend Firm 500’s solely buyer is Buyer C. Since they pay $400 a 12 months, the ACV for 12 months 3 could be $400.

$400 / 1 = $400 per 12 months

Whole contract worth (TCV)

When talking on ACV, it’s essential to the touch on whole contract worth as nicely.

TCV refers back to the whole worth of a contract, together with charges and recurring income. ACV is an efficient worth to measure when figuring out which buyer is providing essentially the most constant earnings, however TCV tells you which ones contract is essentially the most helpful total.

To calculate TCV, merely add the full recurring revenues from the contract to the extra contract charges. For instance, in the event you shut a cope with a $100 onboarding charge and a $20 a month subscription for 12 months, your TCV can be $340.

$100 + ($20*12) = $340

ACV for SaaS companies

Annual contract worth is a extremely valued metric for SaaS companies. As a result of their important income is licensing software program utilizing contracts, the standard worth related when closing a deal will have an effect on the remainder of the enterprise.

SaaS companies like to grasp the benchmark worth of any metric for his or her trade and ask questions like, “What is an efficient ACV for my enterprise?” And naturally, the reply is that it relies upon. Companies might be profitable with each excessive and low ACVs.

As a result of the important thing goal of ACV is to behave as a price to match different metrics in opposition to, the reply will depend on the worth of that second metric. As talked about above, the most typical metric to match ACV with is buyer acquisition value. If your online business has a low CAC, then an ACV on the decrease finish is alright. So long as your ACV can outweigh your CAC, you’re in fine condition.

Take into consideration a enterprise like Adobe, whose merchandise might be offered to particular person shoppers. When promoting to this viewers, the ACV goes to be low as a result of one license is being offered to at least one client, however since the price of buying new clients can be low, the enterprise can nonetheless be worthwhile.

Then again, there are companies like HubSpot that promote to total corporations. Since HubSpot’s options are costlier and contain an extended gross sales cycle, their CAC goes to be fairly excessive. Nevertheless, their ACV can be fairly excessive, to allow them to nonetheless see a revenue.

It’s essential to remain centered on your online business and your online business alone when occupied with what a “good” ACV is.

Easy methods to enhance SaaS ACV

Now that you know the way to measure your annual contract worth and perceive which metrics to match it in opposition to, you may’ve realized that your ACV might use a bit assist.

As a result of ACV relies upon so closely in your particular resolution and marketing strategy, it’s arduous to spherical up a gaggle of things that may be modified to constantly lead to the next ACV. One thing that works for one enterprise might be fully incorrect for an additional.

Nevertheless, there are two issues you are able to do to spice up your ACV that may appear apparent, however are price noting.

1. Deal with up-selling

As your clients and their companies develop, so will their software program wants. Discovering alternatives to up-sell, which is a gross sales method the place a rep makes an attempt to persuade the client to purchase a costlier resolution, is a good way to extend the worth of your common contract. More cash equals extra worth.

Nevertheless, you have to watch out when up-selling to your clients. Sure, it’s your job as a gross sales rep to shut offers for your online business and generate as a lot income as attainable, however you might be additionally there to serve the client. In the event that they really feel pressured to make a buying determination they aren’t prepared for, you can lose their enterprise altogether.

Acquire a deep understanding of their enterprise, look ahead to progress, and current the chance when it makes essentially the most sense for them, not you.

Tip: One of the simplest ways to up-sell is to grasp your clients and anticipate their wants. CRM software program will help you construct that crucial relationship, so when the time comes for them to improve to a brand new resolution, you’ll be prepared.

2. Increase your costs

This one can’t be elaborated on an excessive amount of – elevating your costs will enhance your ACV. Once more, extra money equals extra worth.

Whereas the thought is straightforward, the method of doing so isn’t. When elevating costs, there are some issues that may make your clients offended and stingy with their wallets. Not giving them sufficient discover or tricking them into signing a contract with out mentioning the worth change may end up in these clients strolling away with out a second thought.

You may be capable of get away with elevating your costs, however by no means ever accomplish that maliciously. Deal with your clients the way in which you wish to be handled as a purchaser.

Don’t sleep on annual contract worth

Annual contract worth is an usually neglected and underestimated gross sales metric. Whereas it doesn’t imply a lot standing alone, evaluating ACV in opposition to different values supplies helpful insights when making enterprise selections.

Keep knowledgeable by getting a very good grip on what ACV is sensible for your online business and by no means lose sight of it – otherwise you may undergo the implications.

ACV can be utilized to tell a whole lot of different components of your promoting technique, together with quotas. Be taught the right way to set gross sales quotas that align together with your ACV, profit the enterprise, and inspire your reps.

This text was initially revealed in 2020. It has been up to date with new data.