Many perks accessible out of your bank cards are well-known and well-utilized. Nevertheless, advantages akin to journey cancellation insurance coverage, delayed baggage insurance coverage, misplaced baggage insurance coverage and journey delay safety can fairly actually save the day and justify paying an annual payment.

I am going to clarify a few lesser-known advantages that you simply hopefully will not have to make use of however, if wanted, can defend you from excessive monetary hardship and guarantee your loved ones and family members are offered for if one thing occurs to you.

You’ll be able to simply discover the protection and phrases of any safety your journey bank card gives by doing a fast net seek for the cardboard’s up to date advantages information. These advantages are usually not unique to journey bank cards, and lots of commonplace bank cards include journey safety and insurance coverage.

Journey accident insurance coverage

Usually referred to as frequent provider insurance coverage, this coverage pays in case of dying, lack of eyesight or lack of limb(s) whereas on a aircraft, prepare, ship or bus licensed to hold passengers and accessible to the general public.

A number of playing cards even have journey accident insurance coverage that provides safety for your complete period of a visit (as much as 31 days lengthy) however pays out lower than the frequent provider insurance coverage insurance policies. To be eligible, you need to sometimes pay for your complete fare along with your eligible bank card.

Totally different bank cards have totally different cost tables for a way a lot your beneficiary would obtain in case of dying, shedding one limb, shedding two limbs, shedding sight in a single eye or changing into legally blind. Protection can also be sometimes prolonged to approved customers on the account, spouses, home companions and dependent youngsters of the cardholder on journeys paid for with the cardboard.

By default, the beneficiaries so as of priority are spouses, youngsters after which property. You’ll be able to submit a letter to the cardboard issuer to determine one other beneficiary.

Emergency evacuation insurance coverage

Prior to now, when touring to distant locations like the Maldives and Fiji, I purchased third-party emergency medical evacuation insurance coverage, not realizing the playing cards I already had would have lined me. There are a couple of essential features of emergency evacuation insurance coverage provided by bank cards that it’s worthwhile to perceive and observe so you do not compound your medical state of affairs with the stress of monetary hardship:

- All the things should be accredited and coordinated by way of a advantages administrator. That is who you or your companions ought to name when issues first begin to appear to be you may want help. You’ll not be reimbursed for something that you simply resolve to pay for by yourself.

- Evacuation doesn’t imply repatriation. Should you’re far abroad, you will not be evacuated again to the U.S. Most insurance policies state you may be moved to the closest medical facility able to correct care.

- Preexisting circumstances could result in your request for evacuation on the bank card supplier’s expense being denied. Learn your bank card’s full phrases and advantages information to see which excludes these circumstances and the bank card’s definition of a preexisting situation.

- The protection is just for the price of evacuation and medical care throughout transportation. When you’re again on the bottom, you continue to want medical insurance coverage to pay the docs and workers who present care.

- Some playing cards have nation exclusions, so do not anticipate to go into Syria or Afghanistan and depend on your bank card advantages administrator to get you to a hospital.

Every day Publication

Reward your inbox with the TPG Every day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

To get all of the related data, obtain and browse your complete part of the advantages information pertaining to those coverages. Listed below are a couple of playing cards providing journey accident and/or emergency evacuation insurance coverage.

The Platinum Card from American Categorical

The Platinum Card® from American Categorical gives among the many most beneficiant emergency evacuation insurance coverage of any card.

There’s no price cap, and advantages are prolonged to instant household and youngsters below 23 (or below 26 if enrolled full-time at school). Better of all, you do not even have to make use of the cardboard to pay for the journey.

You should be on a visit lower than 90 days in size and not less than 100 miles away out of your residence. A Premium World Help (PGA) administrator should coordinate all the pieces to not incur any price.

The profit may even pay economic system airfare for a minor below 16 to be returned dwelling if left unattended, pay for an escort to accompany that minor if required to get them dwelling and get a member of the family to the place of therapy if hospitalization of greater than 10 consecutive days is anticipated.*

Different American Categorical playing cards supply entry to the Premium World Help Hotline. Nevertheless, something they coordinate will likely be at your expense. Be sure you learn your Amex card’s advantages information fastidiously.

To study extra, see our full assessment of the Amex Platinum.

Associated: Your full information to Amex journey protections

*Eligibility and profit stage varies by card. Phrases, circumstances and limitations apply. Go to americanexpress.com/benefitsguide for particulars. If accredited and coordinated by Premium World Help Hotline, emergency medical transportation help could also be offered without charge. In some other circumstance, cardmembers are answerable for the prices charged by third-party service suppliers.

Apply right here: Amex Platinum

Chase Sapphire Reserve and Chase Sapphire Most well-liked playing cards

The Chase Sapphire Reserve® gives two journey accident insurance coverage advantages: frequent provider journey accident insurance coverage and 24-hour journey accident insurance coverage. The previous applies whereas using as a passenger in, coming into or exiting any frequent provider. The latter applies any time throughout your journey — however you can’t be paid out on each the frequent provider and 24-hour insurance policies.

Should you use your Chase Final Rewards factors to e-book your journey, you’re lined below the cardboard’s advantages.

Folks eligible for protection embody your self, plus “[a] partner, and fogeys thereof; little children, together with adopted youngsters and stepchildren; mother and father, together with stepparents; brothers and sisters; grandparents and grandchildren; aunts or uncles; nieces or nephews; and Home Associate and fogeys thereof, together with home companions and spouses of any particular person of this definition.”

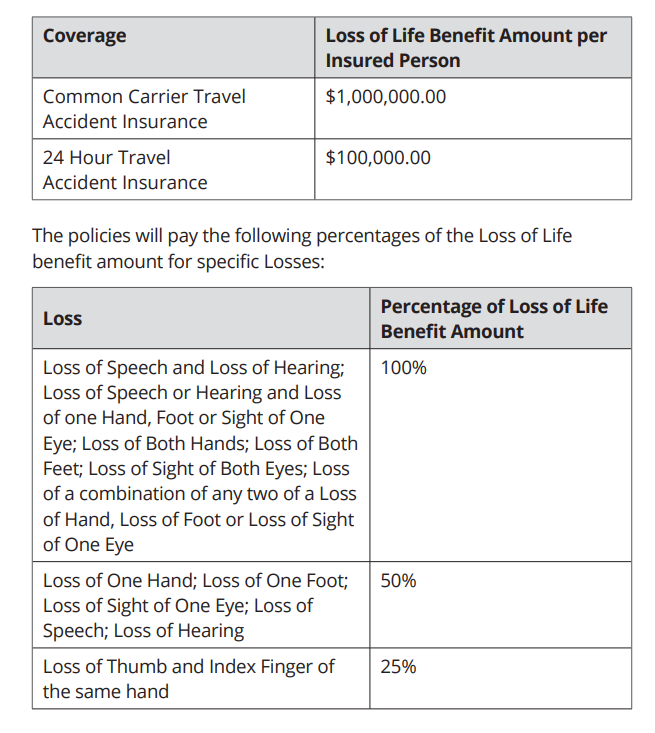

Chase pays as much as $1,000,000 for a typical provider loss and as much as $100,000 for a 24-hour coverage loss based mostly on the next desk:

Some fascinating exclusions with Chase that will forestall a payout embody the insured individual taking part in a motorized vehicular race or velocity contest, the insured individual taking part in any skilled sporting exercise for which they acquired a wage or prize cash, skydiving or if the insured individual touring or flying on any plane engaged in flight on a rocket-propelled or rocket-launched plane.

The Chase Sapphire Reserve additionally gives emergency evacuation insurance coverage. Should you or a direct member of the family paid for not less than a portion of your journey with the cardboard, you are eligible for as much as $100,000 in emergency medical evacuation.

Your lined journey should final between 5 and 60 days and be not less than 100 miles out of your residence. If you’re hospitalized for greater than eight days, the advantages administrator can prepare for a relative or pal to fly round-trip in economic system class to your location.

In case your authentic ticket can’t be used, you can even be reimbursed for the price of an economic system ticket dwelling. In a worst-case state of affairs, the profit additionally pays as much as $1,000 to repatriate your stays.

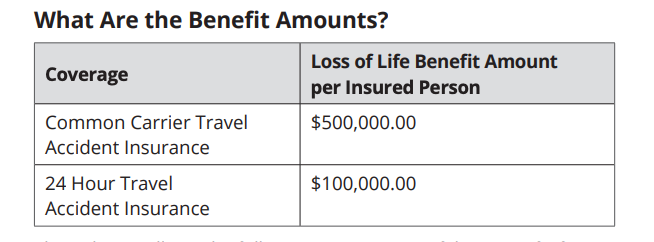

The Chase Sapphire Most well-liked® Card gives journey accident insurance coverage as nicely, however with decrease payouts on the frequent provider coverage. The advantages pay as much as $500,000 for a typical provider loss and as much as $100,000 for a 24-hour coverage loss based mostly on the next desk:

Be certain to fastidiously learn by way of your information to advantages in order that you recognize what your Chase Sapphire card does and doesn’t cowl.

To study extra, see our full evaluations of the Chase Sapphire Reserve and Chase Sapphire Most well-liked.

Apply right here: Chase Sapphire Reserve and Chase Sapphire Most well-liked

United Membership Infinite Card

The highest-tier United Membership℠ Infinite Card gives journey accident and emergency evacuation insurance coverage. The journey accident insurance coverage advantages pay as much as $500,000 for a typical provider loss.

The cardboard additionally carries emergency evacuation protection, so you’ll be able to relaxation assured realizing that you simply’re lined in case of eligible medical occasions. Needless to say the United Membership Infinite’s advantages could have phrases that differ from different Chase playing cards, so learn by way of your card’s information to advantages for extra data.

To study extra, see our full assessment of the United Membership Infinite Card.

Apply right here: United Membership Infinite

Backside line

We hope none of us ever have to fret about both of those insurance policies, nevertheless it’s good to have peace of thoughts in the event you or your loved ones want emergency help. This reassurance is another reason to make sure certainly one of these playing cards is at all times in your pockets when touring.

The profit guides of all playing cards are up to date commonly, so be sure to do not toss them within the trash when updates present up within the mail and browse the net guides for the newest phrases and circumstances.

Associated: One of the best bank cards with journey insurance coverage