Are ESOPs truly a good suggestion?

Warren Buffet is understood to have mentioned about diversification: “[it] makes little or no sense for anybody that is aware of what they’re doing.” As somebody together with his retirement financial savings primarily in diversified index funds, that quote hurts. Then once more, in terms of my retirement financial savings, I don’t actually have the time or need to develop into somebody who “is aware of what they’re doing.” So, I diversify with the purpose of securing the market return and infrequently suggest that others like me do the identical. Which is why when the Safe 2.0 Act was signed into regulation in December 2022, I used to be only a bit nervous concerning the provisions encouraging the adoption of Worker Inventory Possession Plans (ESOPs).

Earlier than getting in to why I used to be nervous, a fast primer is so as. In spite of everything, many individuals studying this put up could also be extra accustomed to Aesop’s Fables than ESOPs (rim shot please). Most likely the quickest technique to clarify ESOPs is to distinction them to the 401(ok), a retirement plan that almost all staff know higher.

Contributions: In a 401(ok), staff contribute a fraction of their salaries – pre-tax for Conventional and post-tax for Roth – into an account. Employers will typically match a portion of their staff’ contributions. In ESOPs, staff usually make no contributions. As a substitute, employers distribute shares of firm inventory to staff’ accounts based mostly on issues like their wage and tenure.

Investments: In a 401(ok), staff select the right way to make investments their contributions from a menu typically together with each actively and passively managed funds. ESOP accounts typically maintain solely worker inventory, though staff can diversify as much as 25 p.c of their accounts’ shares at age 55, rising to 50 p.c by age 60.

Account Worth: In a 401(ok), the worth of 1’s account is often apparent, as a result of the belongings concerned are publicly traded. The worth of an ESOP account is the worth of the employer’s shares. This worth could also be clear if the corporate is publicly traded, however for privately held corporations it’s made out there solely yearly.

Distributions: In a 401(ok), staff older than 59½ can withdraw their contributions and returns as they want (topic to the required minimal distribution guidelines). Withdrawals are topic to the abnormal earnings tax if the contributions have been pre-tax. In an ESOP, distributions are extra plan-specific, and infrequently out of the management of the participant.

From the above, you’ll be able to see why ESOPs are enticing and infrequently obtain bipartisan assist. First, ESOPs don’t require a contribution from staff and are due to this fact typically seen as very best for middle-income staff (though it’s all the time attainable that employers compensate for providing an ESOP by decreasing worker wages). The truth that a few third of ESOPs are in building and manufacturing – industries regarded as squarely middle-income – reinforces this attraction. Second, ESOPs give staff an possession stake of their firm, rising their motivation in addition to their empowerment.

Nevertheless, the distinction to 401(ok)s additionally makes clear why the push for ESOPs makes me a bit nervous. It isn’t simply the truth that at most 50 p.c of staff’ accounts could be invested in an asset outdoors of firm inventory. This lack of funding diversification pales compared to the truth that if one’s solely retirement plan is an ESOP, one’s total life could be non-diversified. One’s wage, medical insurance, and retirement accounts may all be tied up in a single firm.

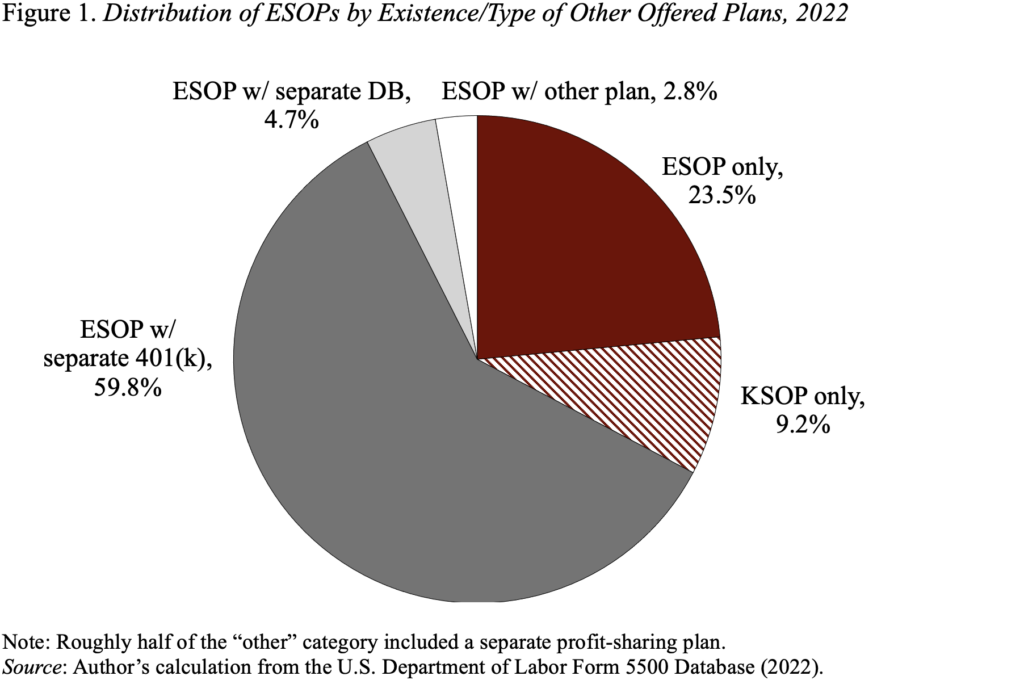

Fortunately, this concern is considerably misplaced. The reason being that – as Determine 1 under reveals – most corporations that sponsor ESOPs additionally sponsor one other plan, usually a 401(ok). Plus, a number of the single-plan corporations with an ESOP mix it with a 401(ok) part into one thing known as a “KSOP,” an acronym for Keystone Financial savings and Revenue-Sharing Plan. In a KSOP, employers present their match by way of firm inventory, however the worker contributions could be invested extra extensively, rising diversification.

Put merely, usually, an ESOP is a complement to – not a substitute for – a extra diversified retirement automobile. If future insurance policies encouraging ESOPs maintain this stability and likewise encourage the adoption of 401(ok)s, then ESOPs will proceed to be a good way to assist staff accumulate wealth whereas additionally encouraging possession and empowerment.