GameStop Corp. GME inventory rose by 3% in premarket hours on Wednesday as the corporate swung to revenue regardless of a dip in its income. Nevertheless, technical evaluation of the GME inventory primarily based on easy shifting averages reveals that it’s oscillating inside an outlined vary.

What Occurred: GameStop recorded a web earnings of $17.4 million for the third quarter that ended Nov. 2, in comparison with a web lack of $3.1 million in the identical interval final 12 months.

The corporate’s web gross sales have been at $0.86 billion for the interval, in comparison with $1.078 billion within the prior 12 months’s third quarter, in response to the GAAP measures.

Why It Issues: GameStop inventory has superior by 61.6% on a year-to-date foundation and declined 11.7% within the final six months. This compares to 18.1% and 11% efficiency by NYSE Composite in the identical interval, respectively.

The corporate, which can also be part of Russell 2000, outperformed the gauge on a year-to-date foundation because it grew by 18.4%. Nevertheless, over the previous six months, GME inventory underperformed R2K, which gained 17.7% throughout this era.

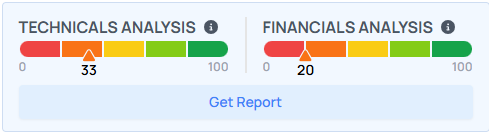

From a technical perspective, the evaluation of each day shifting averages signifies a possible interval of consolidation.

GameStop inventory closed at $26.93 apiece on Tuesday and rose to $27.75 per share in after hours. That is under its eight and 20-day easy shifting averages, of $27.92 and $27.98, respectively. As per Benzinga Professional knowledge, its present inventory value is increased than the 50 and 200-day shifting common costs at $24.34 and $21.30, respectively.

This pattern signifies that the inventory is experiencing near-term downward momentum however it’s nonetheless broadly above its longer-term value motion, indicating consolidation. However, the relative energy index of fifty.42 suggests the inventory was within the impartial area, neither overbought nor oversold.

Benzinga’s technical evaluation scorecard, scores the corporate at 33 factors out of 100, indicating poor momentum.

See Additionally: SoFi Inventory Falls After BofA Downgrade Over Valuation Considerations: Right here’s What Technical Evaluation Exhibits

What Are Analysts Saying: In accordance with Benzinga Professional knowledge, GameStop has a consensus value goal of $16.5 per share primarily based on the rankings of two analysts. Ascendiant Capital’s value goal was $23 apiece as of Dec. 27, 2021. Wedbush’s newest goal from Sept. 11, 2024, stands at $10 per share.

The common value goal of $9.33 apiece between the three newest rankings from Wedbush implies a 66.37% draw back for GameStop.

Learn Subsequent:

Photograph courtesy: Shutterstock

Market Information and Information delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.