Ally Make investments

Product Identify: Ally Make investments

Product Description: Ally Make investments permits you to commerce shares, ETFs, mutual funds, bonds, and choices. There aren’t any commissions, and choices are $0.50 per contract.

Abstract

Ally Make investments affords self-directed with no commissions or minimums. Its automated portfolios require a $100 minimal funding and are both free or 0.30% yearly, relying on the plan you select. In order for you some assist, you too can get a portfolio managed by an advisor and customized recommendation. There’s a minimal of $100,000 for a managed portfolio.

Execs

- Ally Make investments affords each self-directed brokerage, automated, and managed portfolios

- $100 minimal on robo portfolios

- Free automated portfolio out there

- Incoming ACAT payment reimbursement as much as $75

Cons

- Money-enhanced computerized portfolio is free however requires a 30% money place, or you possibly can pay 0.30% per yr

- $100,000 minimal funding for managed portfolios

- No detailed Degree 2 market-level information for doing your individual analysis

For those who’ve been excited about opening an account with Ally Make investments, this assessment is for you.

I’ve been utilizing Ally Make investments as my major inventory brokerage for years. I began with TradeKing, stayed on throughout the acquisition, and have held a large portion of my investments with Ally Make investments.

I’m a fan as a result of they provide free trades, a wealthy suite of analysis instruments, and an interface that’s intuitive and straightforward to navigate. They don’t provide free trades of mutual funds however I spend money on mutual funds immediately with Vanguard so this isn’t a difficulty for me. (Ally Make investments affords free trades on ETFs, although)

At a Look

- Ally Make investments affords automated investing, self-directed investing, and managed accounts.

- No minimal to get began with self-directed investing and $100 minimal for automated investing.

- Managed accounts require a $100,000 minimal funding.

- Low charges and a straightforward to make use of service.

Who Ought to Use Ally Make investments

Ally Make investments is finest for newbie to intermediate buyers who’re snug managing a self-directed funding account. The low minimums and free trades make it very accessible to somebody who doesn’t have loads to take a position however the instruments and options of the account nonetheless assist somebody who wants extra.

For those who simply need mutual funds, skip Ally Make investments and go along with the corporate providing the funds immediately. If that’s Vanguard, open a Vanguard account. If it’s Constancy, open a Constancy account.

In order for you a hands-off managed fund like a robo-advisor, Ally Make investments affords a fairly good product, however examine it with the main robo-advisors at present out there.

It’s not excellent for superior buyers, day merchants, technical merchants, or somebody who wants a variety of market information (Degree 2) to make choices. If that describes you, there are different brokerages that offers you that stage of element into the market.

Ally Make investments Options

|

|||

| Tradable securities | Shares, ETFs, choices | Shares, bonds, ETFs, mutual funds, choices, and futures | Shares (together with OTC), ETFs, choices, and futures |

| Crypto | Sure | No | No |

| Robo-advisor out there | No | Sure | Sure |

| Be taught extra | Be taught extra | Be taught extra |

Desk of Contents

🔃 Up to date December 2024 so as to add the non-public recommendation options and double-check for every other adjustments to the service.

Who’s Ally Make investments?

Ally Financial institution bought into the brokerage sport by acquisition in 2016 and renamed it Ally Make investments Securities, or Ally Make investments for brief. They’re regulated by FINRA, you possibly can search for their itemizing on BrokerCheck, they usually’re licensed to function in all 50 states plus Washington D.C. and Puerto Rico.

Ally Make investments has self-directed buying and selling accounts (taxable brokerage, IRA) in addition to “Robo Portfolios,” which is their time period for his or her robo-advisory-like automated investing companies. We are going to dig extra into each of these account varieties.

Self-Directed Buying and selling Accounts

Ally Make investments has no minimal to get began, and you may commerce most U.S.-listed shares, ETFs, and choices with no commissions.

It helps taxable brokerage accounts in addition to particular person retirement accounts with no minimal. You may commerce virtually all the pieces – shares, bonds, mutual funds, ETFs, choices, and even foreign exchange. The one asset not on that checklist is cryptocurrencies however I don’t spend money on cryptocurrencies – and right here’s why.

Better of all, all these trades are commission-free. Choices have a $0.50 per contract payment, however no base fee is charged.

The platform is fairly refined and affords all the pieces you could possibly want out of your primary brokerage account. There are real-time quotes, analysis, a customizable dashboard, and it’s all accessible on-line. You don’t get Degree 2 market information, although.

Ally makes use of TipRanks “Good Rating,” which charges shares on a scale of 1 to 10 and helps you make faster and extra knowledgeable choices. It additionally has inventory screeners and information corresponding to information, metrics, pricing data, dividend charges, and so on. You may as well entry professional evaluation about particular person shares from TipRanks.

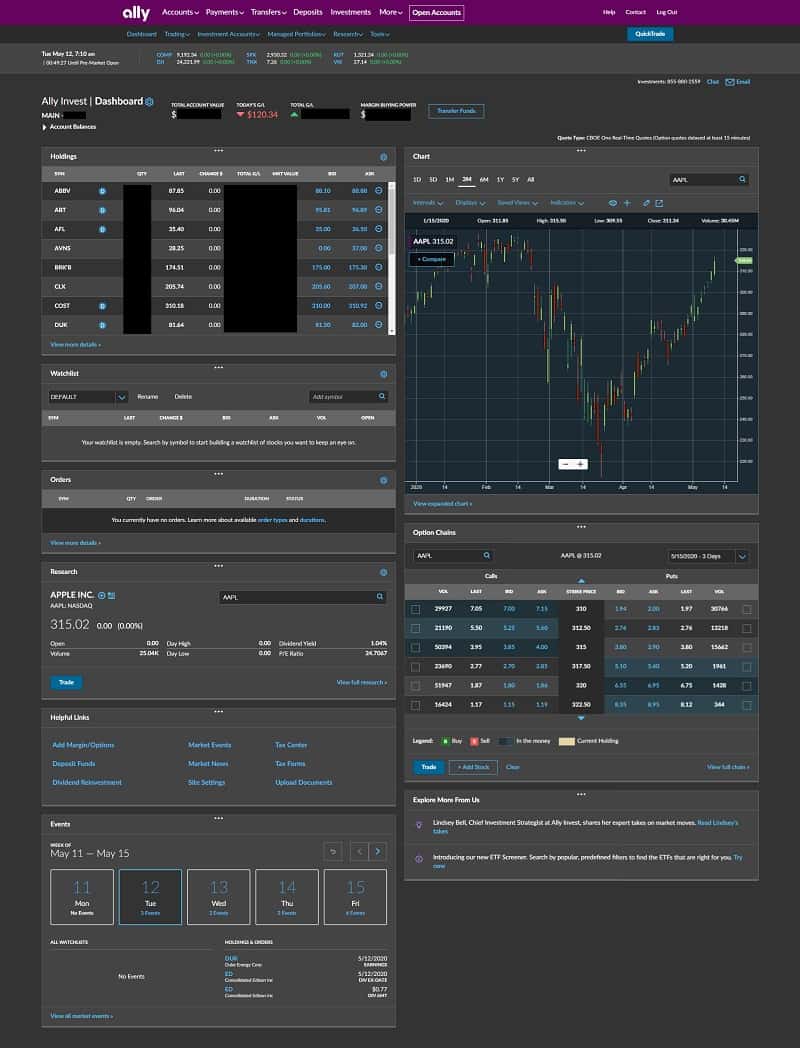

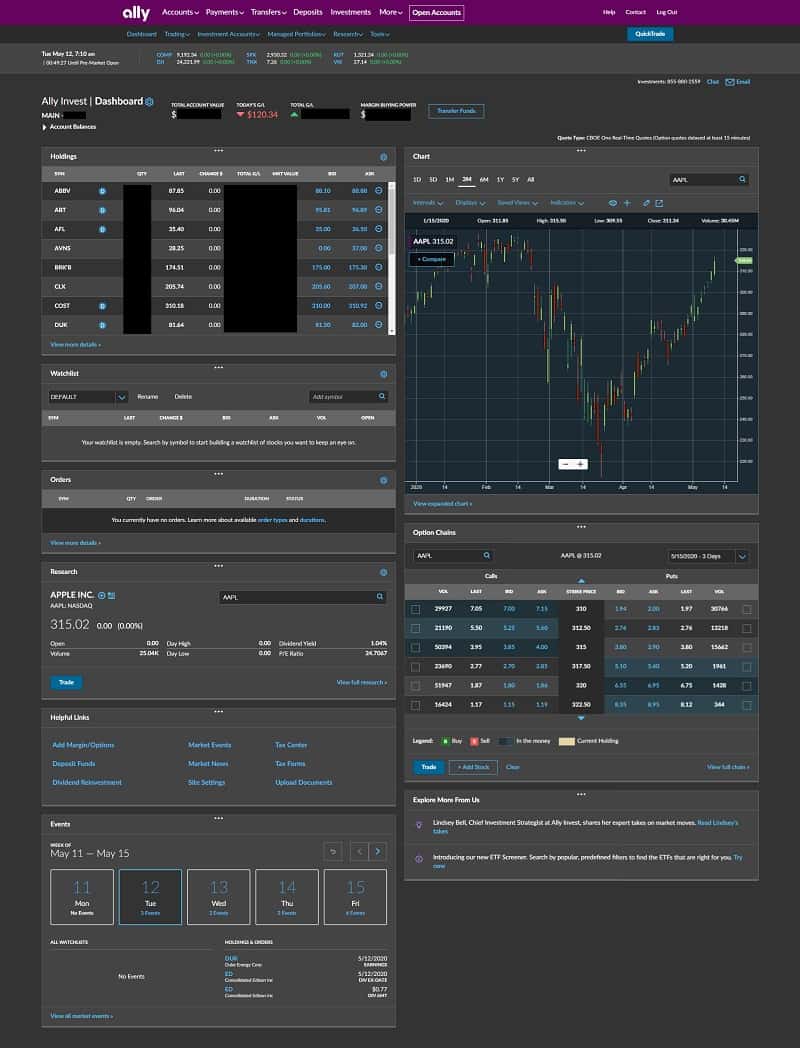

As soon as you’re logged in, you’ll see the default dashboard. They name it Ally Make investments Dwell.

You may customise it, however the default exhibits you a variety of information in a short time, with threads you possibly can pull for added analysis. One of the best ways to make use of that is as a snapshot into your account to see how your portfolio is performing.

The Dashboard could be very well-designed and intuitive to make use of. Whenever you click on on a inventory in your Holdings, all the opposite panels replace to that inventory – the Chart robotically updates to point out you the trailing three months, Choices Chains updates to point out you all the decision and put contracts (the choice chains), and so on. You don’t must manually enter it into every panel every time. Whenever you enter a ticker into the search field inside any panel, it updates each different panel too. That’s sensible.

For personalization, you possibly can change what’s proven inside every panel. You may as well transfer the panels round however you possibly can’t add or take away panels – although I’m undecided if there’s a panel that I’d add that isn’t already right here.

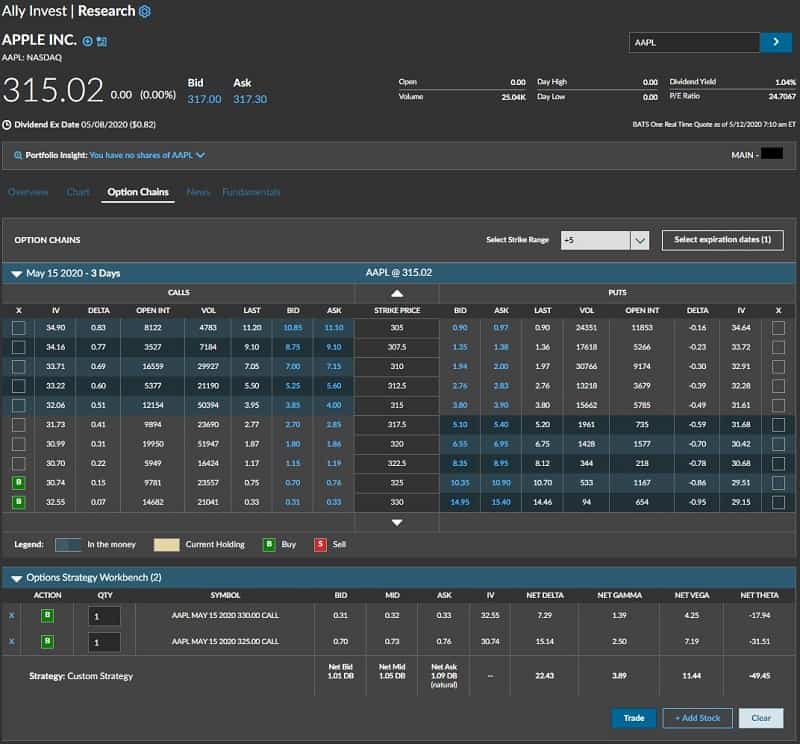

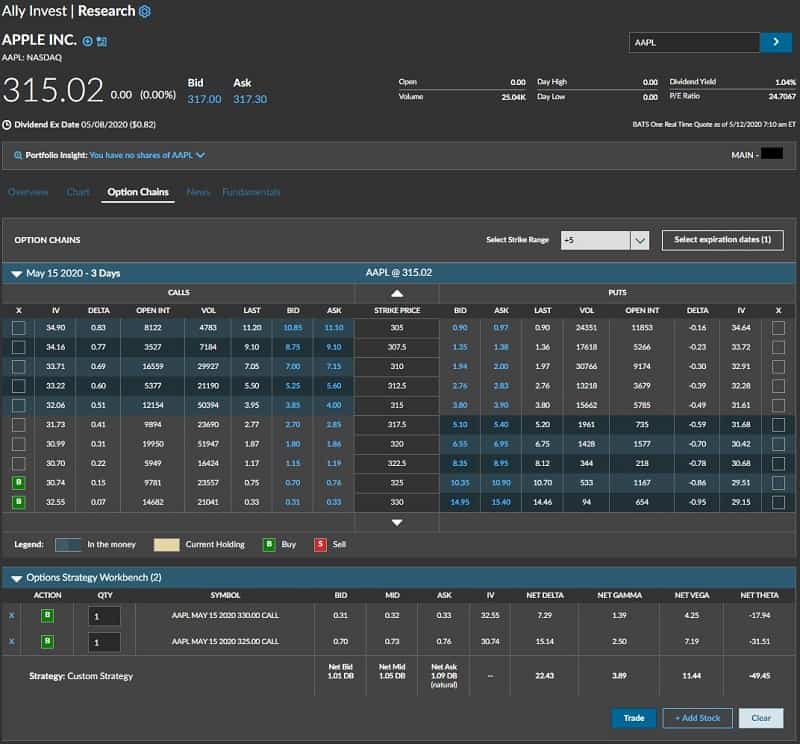

Ally Make investments has good choices forecasting and pricing instruments. Throughout the Choice Chains panel, you possibly can dive into the chain of a inventory and construct an choices technique utilizing their workbench (right here I’m shopping for out-of-the-money calls on AAPL):

✨ Associated: What’s Choices Buying and selling

Price Construction

The payment construction on the self-direct account is just about as little as you will get:

- $0 commission-free trades on shares, mutual funds, choices, and ETFs. Choices have a $0.50 per contract payment.

- $0 account minimal

- No inactivity payment

- $50 ACAT payment

Personally, if you wish to commerce mutual funds, one of the best ways to do this is to open an account with the corporate that provides the funds. For instance, if you would like a Vanguard fund, open a Vanguard account as a result of you should purchase and promote shares without spending a dime. And if you would like a Vanguard ETF, you should purchase and promote these without spending a dime on Ally Make investments or Vanguard.

Ally Make investments Automated Investing

Automated investing is Ally’s robo advisor. You will get began with $100, and you’ve got two portfolio decisions; Money-enhanced and Market-focused.

Money-enhanced portfolio: With this portfolio, there aren’t any advisory charges, however you’ll must maintain 30% of your portfolio in money. The money stability earns a aggressive rate of interest, however is just not FDIC-insured and isn’t as simple to entry as a typical financial savings account.

Market-focused portfolio: With this portfolio, you pay a 0.30% annual advisory payment, and you must maintain about 2% of your portfolio as money.

With robo advisors, you reply some questions on your objectives, they usually’ll construct a mixture of ETFs that meet your objectives. Then, you possibly can tweak it as you would like.

Moreover, you possibly can decide from 4 portfolio choices:

If you’re having bother studying the screenshot, it’s as follows:

- Core: “Extremely diversified throughout home, worldwide, and fixed-income belongings. You may select the quantity of threat you’re snug with, from conservative to aggressive. For those who’re extra of a hands-off investor, contemplate this portfolio sort.”

- Revenue: “This portfolio sort affords greater dividend yields whereas sustaining a extra conservative threat profile. Contemplate this portfolio sort when you’re most targeted on yield and earnings.”

- Tax-Optimized: “For those who make after-tax contributions to an funding account, the sort of IRA might assist maximize your investments. For those who’re seeking to make investments utilizing a various mixture of tax-advantaged, low-cost Trade Traded Funds, contemplate this portfolio sort.”

- Socially Accountable: “Formed by firms with moral monitor data, you’ll solely spend money on companies that actively observe sustainability, vitality effectivity, or different environmentally pleasant initiatives. Contemplate this portfolio sort if eco-friendly practices are essential to you.”

Then, their techniques (and other people) monitor your portfolio and rebalance as wanted. It’s much like the robo-advisory companies of different firms (in concept).

Private Recommendation

For those who don’t wish to make investments by yourself, you will get a devoted advisor to debate your objectives and threat tolerance, and they’re going to put collectively a customized plan for you. You’ll meet for a 15 minute session to be sure you are a very good match and to have all of your questions answered.

Then, you’ll have two or three conferences to get to know you and create your plan. Upon getting accepted the plan, your advisor will implement the plan. You’ll then meet quarterly to assessment and keep the investments.

You’ll want at the very least $100,000 to take a position, and there may be an 0.85% annual payment.

Cell App

Ally Make investments’s cell app has all of the options you’d anticipate in a brokerage’s cell app – together with the power to finish any transaction on the app that you just’d be capable of do on the web site. I don’t use the cell app as a result of I don’t like making main cash choices (like shopping for and promoting shares of inventory) on my telephone. I want to sit down at a desk, have a look at a pc display screen, and “get into work mode.”

It’s somewhat more durable to do analysis on the telephone as the one place the place “information” is pulled into the app is on the analysis web page, and the one supply seems to be from MT Newswires.

But when there was some sort of emergency or pressing want, I might do it.

Ally Make investments Options

Ally Make investments has carved out a pleasant spot as a reduction brokerage that does all the pieces nicely, however how does it examine with some others?

Robinhood

At Robinhood, you should purchase shares, ETFs, and choices. You may as well commerce fractional shares and cryptocurrency, which you’ll be able to’t do at Ally.

In relation to instruments, Robinhood doesn’t have the evaluation instruments that Ally Make investments affords. Whereas they offer you entry to the identical tradable securities, Ally Make investments’s choices instruments far exceed these supplied by Robinhood. Robinhood doesn’t have the breadth and depth of analysis both – they maintain prices low so that they’ve opted to not provide any analysis from different companies. You may nonetheless get publicly out there information, convention calls, and so on. – however something additional is unavailable.

Robinhood’s declare to fame was a slick cell software with free trades. Whereas not each different brokerage has an excellent cell expertise, a lot of them have matched them the place it counts probably the most – free trades. Ally Make investments affords free trades, too, and Ally Make investments’s cell app does all the pieces Robinhood’s app does, but it surely simply doesn’t look as slick.

The underside line is that Ally Make investments affords all the pieces Robinhood does (besides crypto and fractional shares), plus you possibly can tack on a stable on-line banking expertise multi function spot.

Right here’s our full Robinhood assessment for extra data.

ETrade

ETrade and Ally Make investments are very comparable in that they’ve been competing within the low cost dealer class for ages. You may commerce shares, bonds, ETFs, mutual funds, choices, and futures. ETrade additionally has a robo-advisor service for 0.30% yearly.

Whereas they’re very comparable, ETrade’s massive differentiator is that it helps you to create paper buying and selling portfolios that will help you dip your toe into investing. With a wealth of academic instruments, you possibly can research shares and use their portfolios to see the way you’re doing with a “observe” account.

ETrade has a $500 account minimal on their brokerage accounts band whereas trades of choices are free; there’s a $0.65 per contract payment at ETrade except you make 30 trades per quarter, then it drops to $0.50. Choices are all the time $0.50 at Ally Make investments.

Right here’s our full ETrade assessment for extra data.

✨ Associated: Greatest Inventory Brokers that Supply Free Trades

Webull

At Webull, you possibly can commerce shares, ETFs, choices, and futures. You may as well commerce fractional shares, which you’ll be able to’t do at Ally Make investments. In addition they provide over-the-counter securities, together with ADRs and derivatives. It additionally has in a single day buying and selling, which lets you commerce 24 hours a day, 5 days every week.

Webull additionally affords a robo-advisor service when you don’t wish to handle your individual portfolio.

For analysis, Webull offers you entry to the basics, corresponding to earnings statements, stability sheets, and money movement statements. You may as well get real-time insights to grasp what has been occurring not too long ago to the funding. For instance, you possibly can see if a inventory has had an uptick in shorting exercise. You may as well simply add occasions to your calendar, corresponding to firm earnings calls, so you possibly can keep up to date.

Right here’s our full assessment of Webull for extra data.

Last Verdict

Ally Make investments is a superb all-around brokerage account due to its $0 minimal and commission-free trades on shares, bonds, mutual funds, choices, and ETFs. I’ve been utilizing them for years and have by no means had any points. With no minimal, affiliation with an excellent financial institution in Ally Financial institution, it’s a very good place for any investor seeking to begin investing.

I first fell in love with them as a result of they supplied cheap trades, however now that so many brokerages are providing free trades, I’ve stayed for the benefit and ease of the platform.