Technically, l I suppose that I can’t say that I don’t put money into Chinese language shares in any respect, since I advocate for utilizing Canadian all-in-one ETFs, and have ETFs equivalent to VXC on my finest Canadian ETFs record.

That stated, I’d by no means advocate for investing instantly in Chinese language shares. I didn’t like the thought when their inventory market was on a tear – and I undoubtedly don’t prefer it now when it’s struggling! It ought to go with out saying that you simply received’t discover any Chinese language shares on my finest dividend shares record both, as a result of most Chinese language firms don’t pay dividends.

Because of among the extra constructive headlines about Chinese language stimulus as of late, I’m seeing increasingly columns being written about firms listed on the Shanghai and Hong Kong inventory markets. Maybe it has one thing to do with the wealthy valuations that US tech heavyweights are presently buying and selling at.

In any case, I can see the attract of the excessive development charges and the sheer scale of the home economic system in China. That stated, there are simply so many dangers and tradeoffs that we aren’t conversant in within the Western market in relation to investing in Chinese language equities.

Regulatory Uncertainty within the Chinese language Inventory Market

The Chinese language authorities’s regulatory framework is a shifting goal. The continually altering guidelines create a unstable and unpredictable surroundings for traders. Regulatory crackdowns, typically sudden and far-reaching, have hit industries like expertise, schooling, and actual property, wiping billions off the valuations of as soon as high-flying firms.

For instance, in 2021, the Chinese language authorities primarily banned on-line for-profit tutoring firms, devastating a multi-billion greenback sector in a single day. (And placing hundreds of native-English-speaking digital nomads out of labor.) Equally, tech giants like Alibaba and Tencent confronted fines and restrictions as a part of a broader antitrust crackdown.

Google “Jack Ma” (also known as the Chinese language Jeff Bezos) for extra particulars on how visionary entrepreneurs can generally be handled in China. These choices, typically missing transparency or clear communication, go away traders uncovered to dangers which can be just about unimaginable to foretell.

For traders, this implies the basics of a Chinese language firm might not matter as a lot because the whims of policymakers. The Chinese language authorities maintains various levels of management over most massive Chinese language firms. State-Owned Enterprises (SOEs) dominate sectors equivalent to power, banking, and telecommunications, whereas even non-public firms aren’t proof against authorities interference.

That heavy authorities involvement within the inventory market can considerably erode shareholder worth. For instance, the rise of “golden shares” permits the federal government to safe controlling stakes in non-public firms, guaranteeing alignment with the federal government’s political aims – versus merely maximizing shareholder worth.

Accounting Transparency Points in Chinese language Companies

I personally suppose that probably the most underreported concern with reference to investing in Chinese language firms is the dearth of accounting transparency. Dependable monetary reporting is the unsung hero of functioning funding markets.

With out confidence that traders can depend on the info firms are exhibiting them, it’s unimaginable to consider they’ll decide the truthful worth of an organization. The absence of constant oversight in Chinese language corporations leaves traders susceptible to manipulation and outright fraud.

This subject is compounded by way of advanced company constructions, weak enforcement of worldwide accounting requirements, and restricted auditing entry for international regulators. Chinese language firms often function beneath completely different reporting requirements than these enforced in North America or Europe. Whereas many publicly-listed firms declare to make use of Worldwide Monetary Reporting Requirements (IFRS) or Typically Accepted Accounting Rules (GAAP), the precise enforcement of those requirements is inconsistent.

This lack of oversight creates an surroundings the place you’ll be able to’t actually belief the numbers that firms are placing ahead.

And I get it should you learn that and thought, “Effectively, aren’t there a couple of firms in the remainder of the world doing this?” Truthful level – however often these firms are caught and punished (by shareholders if not governments) sooner fairly than later. There’s additionally a query of frequency and scale in relation to “inventive accounting”.

One outstanding instance of the issues that generally happen is Luckin Espresso. This caffeine darling was as soon as hailed because the “Starbucks of China”. The corporate went public in 2019 and caught traders’ consideration primarily based on huge income development and wonderful prospects inside the Chinese language market. (Any time you will be the “Starbucks” of something, AND any time you will be the “of China” for something – that intuitively appears like a great gross sales pitch.)

Nevertheless one 12 months later it was revealed that Luckin had made up over $300 million in gross sales by creating faux transactions. The inventory plummeted by 75% in a single day, was kicked off of inventory exchanges, and crippled many traders.

For a more moderen instance, simply have a look at the currently-unfolding Evergrande scandal. China Evergrande Group, one of many nation’s largest actual property builders, reported robust income and asset development for years – whereas brushing their huge debt beneath the desk.

How was it in a position to do all that brushing one may ask?

With the assistance of blind eyes from a number of layers of presidency. The native Chinese language governments had each incentive to maintain these land improvement offers going it doesn’t matter what. I feel we’ve got but to uncover simply what number of liabilities the corporate has that have been by no means formally on its steadiness sheet. Whereas the Chinese language authorities stepped in to assist out home bond holders, shareholders and international bond holders have been mainly worn out.

Geopolitics and Chinese language Investments

China’s strained relationships with Western nations – particularly the world’s largest economic system (by far) United States – provides one other layer of complexity to think about when making an attempt to think about the worth of any single Chinese language firm. Each firm on this planet has these kinds of issues (simply ask the parents who have been banking on the Keystone XL pipeline). However massive Chinese language firms look like working up in opposition to geopolitical constraints greater than most – they usually’re continually evolving.

Simply have a look at Canada’s relationship with China as a non-US instance. A number of years in the past, Huawei was a great guess to land billions of {dollars} price of enterprise throughout Canada. (Mockingly, it might have benefited from stealing Canadian expertise with a purpose to get a aggressive benefit.) That momentum then turned on a dime when the Canadian authorities primarily banned the corporate. There have been fallout shocks throughout each economies from that call.

Extra lately, with a purpose to be certain they have been appropriately positioned for all-important free-trade talks with the USA, Canada bowed to US stress and put a 100% tariff on Chinese language EVs – successfully banning them. Oh after which there’s the entire Tik Tok saga (maybe finest defined right here by John Oliver).

That’s all earlier than we point out the large elephant on this planet of some form of battle over Taiwan – maybe the most important geopolitical concern on the planet!

China’s Financial Slowdown

Whereas China’s economic system has grown quickly over the previous few many years, latest information factors to a slowdown. Structural points equivalent to rising debt ranges, demographic challenges, and lowering productiveness have raised issues about long-term sustainability.

It doesn’t take a genius to determine {that a} rapidly-greying inhabitants isn’t a recipe for financial development. Much less customers, extra pensioners isn’t nice math for China. Not like Canada and even the USA to a big extent, China isn’t used to integrating massive numbers of immigrants with a purpose to reasonable the getting older pattern. Giant teams of immigrants aren’t precisely climbing over themselves to maneuver to China, work for comparatively low wages, and should be taught Mandarin or Cantonese.

Add to these getting older inhabitants struggles, the challenges of rising debt hangovers, trade-wars, elevated army spending – and the entire thing can look fairly shaky. You toss within the impression of a warming planet, and a potential army confrontation within the South China Sea, and the chances that Chinese language shares are a nasty long-term funding begin to construct up.

Lastly, in relation to their foreign money, the Chinese language Yuan is tightly managed by the federal government, making foreign money threat one other essential issue. Fluctuations within the yuan’s worth, pushed by political or financial pressures, can considerably impression the returns on Chinese language investments. For instance, during times of commerce pressure, the Chinese language authorities has allowed the yuan to depreciate to make exports extra aggressive. Whereas this advantages exporters, it will possibly erode the worth of international traders’ holdings.

Chinese language ETF Publicity

Regardless of all of the financial headwinds that I simply listed above, I truly suppose the Chinese language economic system will develop within the subsequent few many years (simply not almost as rapidly as they declare it’s going to). The larger subject for traders is whether or not any of these positive factors will translate into elevated income for Chinese language firms.

In any case, many firms promote merchandise in China, and profit from their elevated financial may. In the event you’re invested in Apple, Tesla, or Louis Vuitton and Moët Hennessy (LVMH), then you have already got publicity to the Chinese language economic system.

Chinese language financial development for the final 5 years has been 5% – fairly stable in comparison with a lot of the remainder of the world. But right here’s what the Shanghai Composite Index (the place a lot of China’s largest shares are listed) has regarded like.

SSE Composite Index:

Fairly lackluster development.

That stated, should you’re invested in an ex-Canada ETF (equivalent to VXC) or an all-in-one ETF (like VEQT or XEQT), then you definately truly have already got some direct publicity to Chinese language shares.

XEQT:

| Nation | Proportion (%) |

| United States | 46.43 |

| Canada | 24.83 |

| Japan | 5.48 |

| United Kingdom | 3.33 |

| Switzerland | 2.11 |

| Australia | 1.91 |

| Germany | 1.83 |

| China | 1.31 |

| Netherlands | 1.02 |

| India | 1.01 |

VEQT:

| Nation | Proportion (%) |

| United States | 45.77 |

| Canada | 30.22 |

| Japan | 4.07 |

| United Kingdom | 2.51 |

| China | 2.05 |

| India | 1.61 |

| France | 1.57 |

| Switzerland | 1.45 |

| Taiwan | 1.42 |

| Germany | 1.34 |

| Australia | 1.30 |

| Republic of Korea | 0.79 |

| Netherlands | 0.64 |

| Sweden | 0.57 |

| Denmark | 0.49 |

VCN:

| Nation | Proportion (%) |

| United States | 65.24 |

| Japan | 5.91 |

| United Kingdom | 3.65 |

| China | 2.92 |

| India | 2.30 |

| France | 2.29 |

| Switzerland | 2.11 |

| Taiwan | 2.02 |

| Germany | 1.94 |

| Australia | 1.89 |

| Republic of Korea | 1.15 |

| Netherlands | 0.92 |

| Sweden | 0.83 |

| Denmark | 0.71 |

| Italy | 0.70 |

The competitors between the most effective on-line brokers in Canada, has led to Qtrade providing free ETF shopping for and promoting of XEQT, in addition to its much less dangerous all-in-one cousins, XBAL and XGRO. There’s additionally a China Index ETF obtainable: XCH (however as you’ve possible gathered from this text, I’m not a fan). You’ll be able to see our full Qtrade overview for extra particulars.

One Chinese language Inventory I May Take into account

Aside from the Canine of the TSX strikes that I make, I’m not a giant inventory picker as of late.

That stated, as an engineer, there’s one firm that has caught my consideration over time.

Actually, it’s the entire Chinese language Electrical Car (EV) business normally – however it seems that Construct Your Goals (BYD) is shaping as much as be the unstoppable power that may outcompete the remainder of China’s automakers.

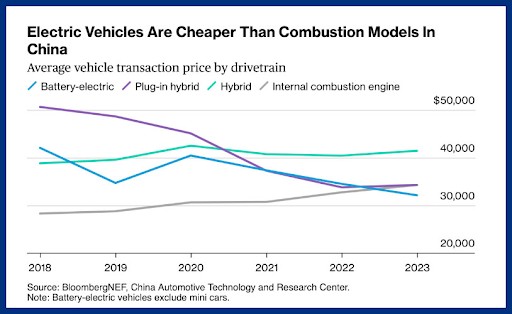

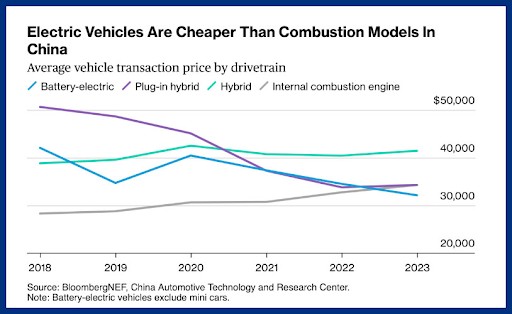

The expansion of the corporate has been unimaginable, and the cut-throat competitions between Chinese language EV firms has led to plunging prices. It has now gotten to the purpose the place EVs are cheaper than conventional inside combustion (ICE) engines. I’m not speaking about “lifetime possession prices” – I’m speaking straight up, price ticket on the automobile lot prices.

If you wish to understand how the EV finish sport is prone to play out, check out Australia (who presents an equal taking part in discipline, with no tariffs on any automobile imports). Chinese language EVs now make up 80% of the EV market there!

The truth that Warren Buffett owns a stable chunk of BYD additional piques my curiosity. As I stated above, I’m not a giant fan of Chinese language shares, but when I needed to decide one, BYD could be the guess.