If you happen to’ve received a house fairness line of credit score (HELOC), fee aid might lastly be right here.

The Fed is predicted to “pivot” right this moment, that means they’ll shift from a tightening financial coverage to a loosening coverage.

In different phrases, they’re going to start out chopping charges as an alternative of elevating them!

Whereas this received’t have a direct influence on long-term mortgage charges, it instantly impacts loans tied to the prime charge, together with HELOCs.

This implies your HELOC charge will go down by regardless of the Fed cuts. So in the event that they lower 25 foundation factors right this moment, your HELOC charge will likely be adjusted down 0.25%.

Although one lower isn’t doubtless to supply main aid, there are expectations that that is the primary lower of many, with probably 200+ bps of cuts penciled in over the following 12 months.

So should you’ve been given the choice to “lock your HELOC charge,” it’s most likely greatest to present it a tough cross.

How HELOC Charges Are Decided

As a fast refresher, HELOCs are variable-rate loans, that means they will alter every month primarily based on the prime charge.

To return along with your HELOC charge, you mix the HELOC’s margin, which is mounted, and the prevailing prime charge, which strikes in lockstep with the fed funds charge.

Each time the Fed decides to lift or decrease its personal fed funds charge (FFF), the prime charge can even go up or down by the identical quantity.

Since early 2022, the Fed has raised the FFF 11 instances, from near-zero to a spread of 5.25% to five.50%.

Immediately, they’re anticipated to decrease the FFF both 25 or 50 bps. This implies banks will decrease the prime charge by the identical quantity shortly after.

Fast be aware: The Fed doesn’t management long-term mortgage charges, so their motion right this moment received’t instantly influence the 30-year mounted. In the event that they lower the 30-year mounted might truly rise right this moment!

Anyway, let’s assume you may have a margin of two% and prime is presently 8.50%. That’s a ten.50% HELOC charge. Ouch!

But when the Fed cuts 25 bps or 50 bps right this moment, that charge will fall to 10.25% or 10%. Okay, we’re getting someplace.

Nonetheless not a low charge, although it’s lastly not going up and in reality is coming down.

Now consider one other 200 bps of cuts and the speed is down to eight%. Candy, that would truly lead to some respectable curiosity financial savings and a decrease month-to-month fee!

What Is Locking Your HELOC Anyway?

That brings us to “locking your HELOC.” As famous, HELOCs are variable-rate loans.

However the banks will typically provide the alternative to lock the rate of interest in for the rest of the mortgage time period. This occurred to my good friend, who requested right this moment if he ought to lock in his charge.

This solely occurs when you’ve had the HELOC open for a time period and made attracts on it. Not upfront, in any other case that’d merely be a fixed-rate residence fairness mortgage.

So Financial institution X would possibly say hey, we all know charges have been rising and there’s lots of uncertainty on the market.

If you happen to don’t wish to cope with any additional changes, you possibly can lock within the charge you presently have.

For these not taking note of the Fed, this would possibly sound like a good concept. In any case, many householders are risk-averse, which is why additionally they don’t are likely to go together with adjustable-rate mortgages.

And lots of debtors might not have truly recognized that their HELOC was variable to start with.

They may soar on the supply to lock within the charge and cease worrying. However this might truly be a horrible time to do this.

You watched helplessly as your HELOC went up and up over the previous couple years. And now you’re going to lock it in, when charges are lastly slated to fall?

In all probability not a good suggestion. This is able to simply profit the financial institution, who will make loads much less should you merely do nothing and let the speed fall as prime drifts decrease and decrease over the following 12 months.

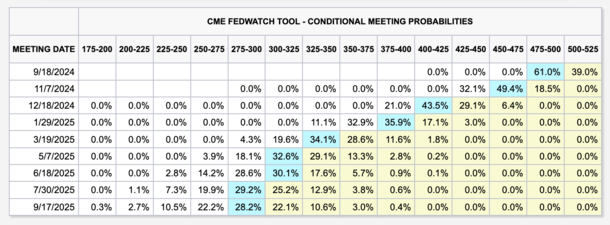

If you happen to’re curious the place the prime charge is predicted to go, regulate the fed funds charge predictions. A very good place to do this is the CME web site.

They’re presently predicting a chief charge that’s 2.25% decrease by September seventeenth, 2025, as seen within the desk above.

In different phrases, when you’ve got a HELOC set at 10% right this moment, it could be 7.75% in 12 months. Don’t lock within the 10% charge and miss out on these financial savings!

Replace: The Fed lower its personal charge 50 foundation factors right this moment, so HELOCs will likely be .50% cheaper at their subsequent adjustment (usually 1st of subsequent month). Good little win for many who already maintain one.