The temporary’s key findings are:

- After a century of decline, work exercise amongst older males stabilized within the Nineteen Eighties and commenced to rise within the early Nineties.

- This turnaround mirrored modifications in Social Safety, retirement plans, the character of labor, training ranges, and well being protection.

- In response, the common retirement age for males rose by about three years to 64.

- In recent times, it has remained comparatively steady because the modifications that drove the rise have performed themselves out.

- Thus, additional important will increase within the common retirement age are unlikely.

Introduction

After practically a century of decline, work exercise amongst older males stabilized within the Nineteen Eighties and for the reason that early Nineties the common retirement age has elevated by about three years. The query is whether or not the components that led to the rise during the last 30 years – modifications to Social Safety, retirement plans, the character of labor, academic attainment, and so forth. – will proceed to push out the retirement age or have they, for essentially the most half, performed themselves out.

This dialogue proceeds as follows. The primary part places the final 30 years in context by exploring the explanations for the decline in labor pressure participation of males between 1880 and 1980. The second part appears to be like on the turnaround in labor pressure participation and the rise within the common retirement age that started within the early Nineties. The third part discusses the components chargeable for this turnaround, and the fourth part assesses the doubtless future influence of those components. The ultimate part concludes that the forces resulting in elevated participation of older employees could be exhausted, suggesting additional will increase within the common retirement age are comparatively unlikely.

The Lengthy-term Decline in Employment Charges

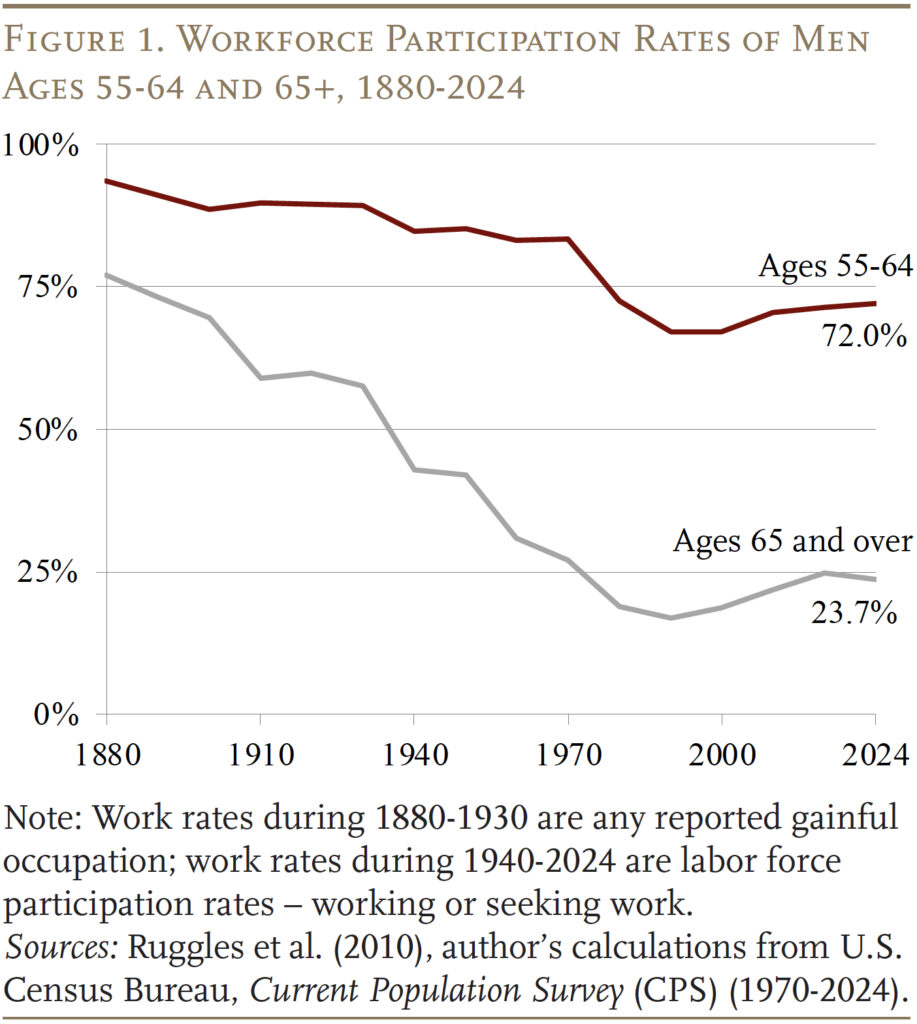

Previous to the Eighties, males usually labored so long as they may, and on the finish of their lives, that they had solely about two years of ‘retirement,’ usually as a result of sick well being.1 (Males are the main focus of this early dialogue, as a result of shifts within the work patterns of older girls have extra to do with their altering roles over the twentieth century than with their retirement selections.) Starting round 1880, the share of older males at work started to say no sharply (see Determine 1).

So, why did workforce participation begin to drop? Specialists attribute this decline to an sudden and substantial stream of earnings that appeared within the type of old-age pensions for Civil Conflict veterans. Veterans eligible for these pensions had considerably greater retirement charges than the inhabitants at giant.2

Apparently, because the veterans died off, work charges didn’t return to their earlier ranges. One clarification is the expansion of employees’ incomes, which allowed them to buy extra leisure on the finish of their lives.3 However employer attitudes had been additionally turning into necessary. The U.S. workforce was quickly shifting from self-employment, most notably in agriculture, to staff of enormous enterprises. Employers more and more launched obligatory retirement ages for his or her staff. They usually had been reluctant to rent older employees, particularly through the Nice Despair.4

The following huge decline within the work charges of older males occurred after World Conflict II. One apparent issue was the provision of Social Safety advantages, which started in 1940. The postwar interval additionally noticed the growth of employer pensions, as union energy grew and firms more and more acknowledged pensions as an important part of their personnel techniques.

The introduction of Medicare in 1965 and the sharp improve in Social Safety advantages in 1972 in all probability led to the ultimate leg of the decline in workforce exercise of older males. And, as a result of advantages had been out there at age 62, Social Safety can also clarify a part of the decline in workforce exercise for males ages 55-64.

The Turnaround

The downward trajectory stopped across the mid-Nineteen Eighties and, for the reason that early Nineties, the labor pressure participation of males each 55-64 and 65+ has steadily elevated. This sample has led to a rise within the “common retirement age.” The dialogue begins by persevering with with the give attention to males, after which turns to the extra sophisticated story for ladies.

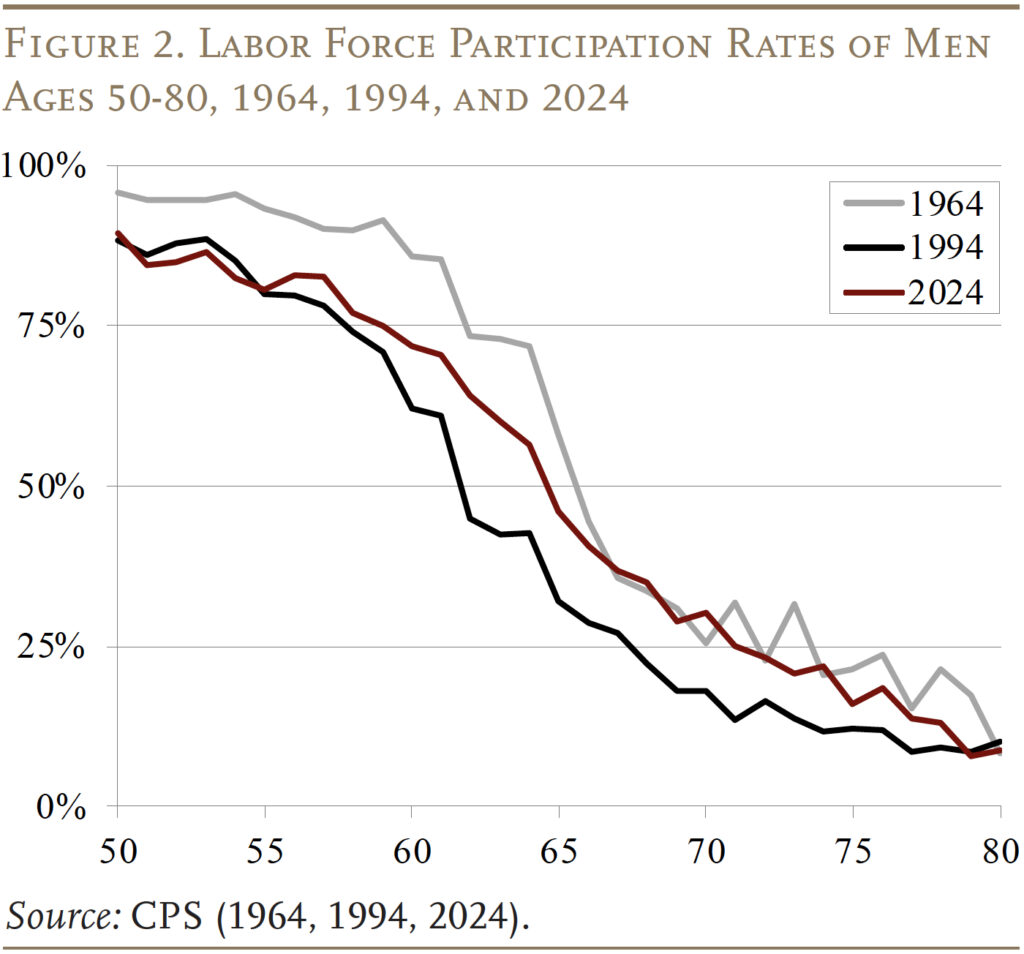

To place the magnitude of the turnaround in perspective, it’s helpful to take a look at labor pressure participation charges in three totally different years: 1964 – earlier than the “reversal;” 1994 – in regards to the time the reversal started; and 2024 – the newest statement. Probably the most hanging change is that labor pressure participation in 2024 was greater at nearly any age than it was in 1994 (see Determine 2). The connection between 2024 and 1964 can be attention-grabbing. At older ages, 2024 participation for males appears to be like similar to that in 1964. In distinction, participation between ages 50 and 65 is dramatically decrease in 2024 than in 1964.

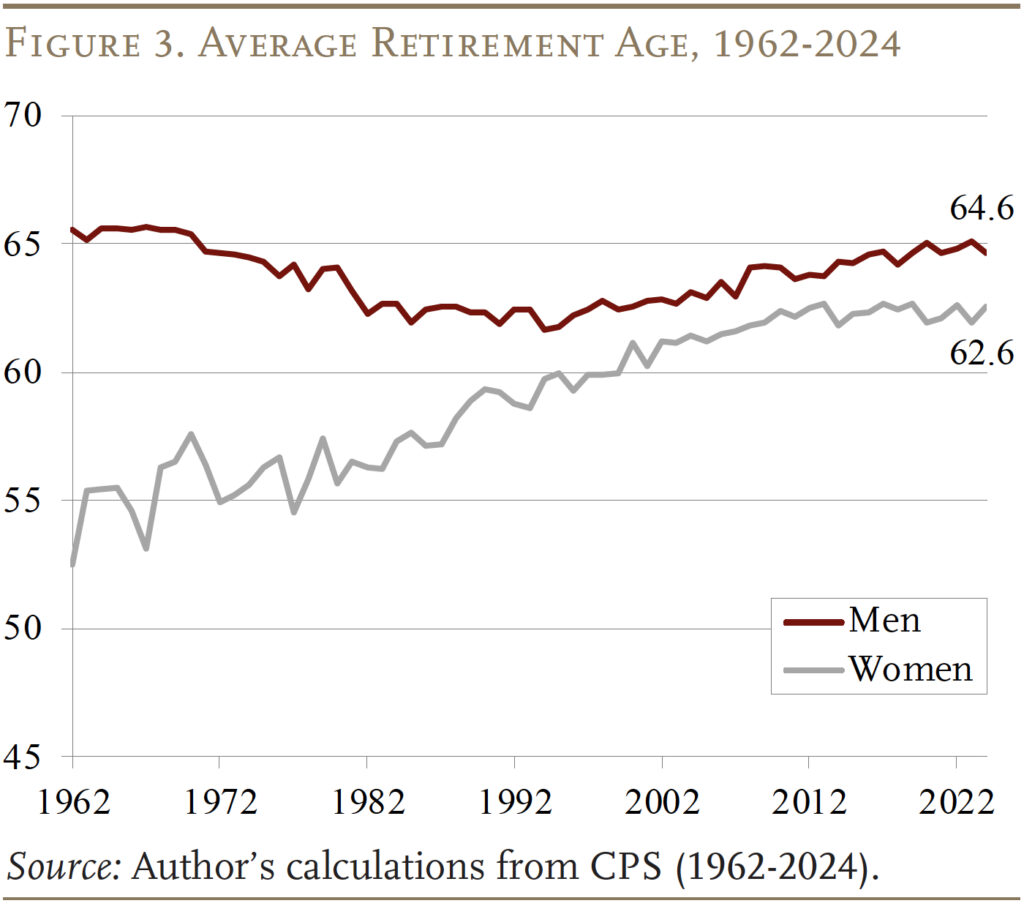

These information on labor pressure participation can be utilized to assemble a measure of the common retirement age, outlined because the age (in years and months) at which the labor pressure participation charge drops under 50 p.c.5 Primarily based on this definition, in 2024 the common retirement age for males was 64.6, three years later than 1994 and nearly again to the Nineteen Sixties (see Determine 3).

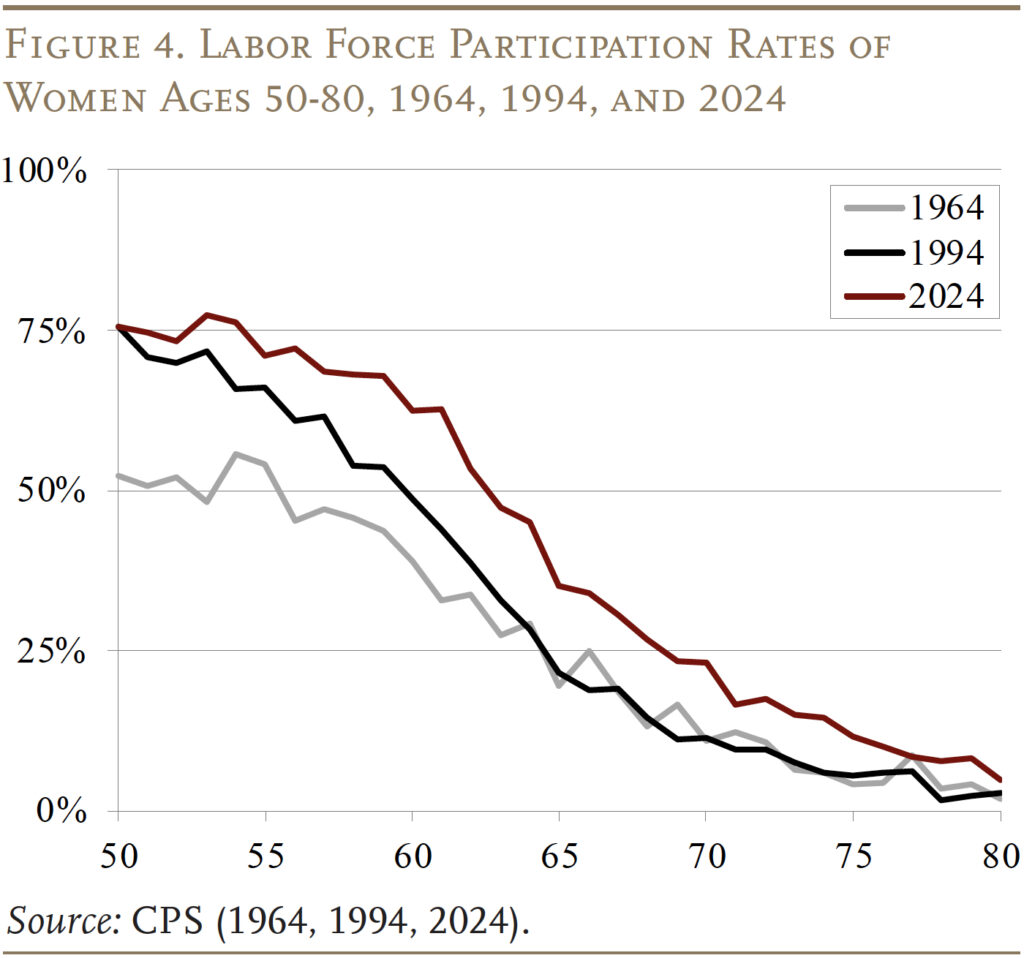

Determine 3 additionally exhibits the common retirement age for ladies. Over the twentieth century every cohort of ladies had spent extra time within the labor pressure than the earlier cohort, rising the probability that they might be working at older ages. Certainly, the participation charge information present work exercise amongst older girls rising steadily from 1964 to 1994 to 2024 (see Determine 4).

The altering work lives of ladies make it tough to interpret tendencies of their common retirement age. Determine 3 means that the retirement age for ladies rose dramatically from about 55 within the Nineteen Sixties to 62.6 in 2024. In fact, the obvious low retirement ages within the early Nineteen Sixties merely replicate the truth that fewer girls had spent a lot time within the labor pressure. In recent times, the common retirement age for ladies seems to have stabilized. The questions are, for each women and men, why did the rise within the common retirement age happen and the place will we go from right here?

Causes for the Turnaround

As famous, the downward trajectory stopped across the mid-Nineteen Eighties and, for the reason that early Nineties, the labor pressure participation of males each 55-64 and 65+ has steadily elevated. Many components assist clarify this turnaround.6

- Social Safety: Adjustments to Social Safety made work extra engaging relative to retirement. The liberalization, and for these on the Full Retirement Age (FRA) the elimination, of the earnings take a look at eliminated what many seen as an obstacle to continued work.7 The rise within the FRA from 65 to 67 lowered advantages for these claiming early. And, the improved delayed retirement credit score elevated incentives to maintain working between the FRA and age 70.8 One latest estimate suggests these modifications had been chargeable for about one-fifth of the rise in work for these ages 65-69.9 Clearly different components additionally performed a task.

- Pension kind: The shift from outlined profit to 401(ok) plans eradicated built-in incentives to retire.10 Furthermore, since 401(ok) members bear funding threat, they should work longer to build up a buffer towards prematurely exhausting their sources. Research present that employees coated by 401(ok) plans retire a yr or two afterward common than equally located employees coated by an outlined profit plan.11

- Schooling: Schooling is a key determinant of employee productiveness. Higher-educated employees have much less bodily demanding jobs, extra employment alternatives, are paid extra, and work longer. Between 1985 and 2015, the share of older employees with school levels elevated sharply, and the academic hole between older and prime-age males largely disappeared. The motion of enormous numbers of males up the academic ladder helps clarify the rise in participation charges of older males.12

- Improved well being and longevity: Common life expectancy for males at 65 has elevated about 3.2 years since 1990, and till 2010 the proof prompt that individuals had been more healthy as effectively.13 The correlation between well being and labor pressure exercise could be very sturdy, which means that the rise in disability-free life expectancy would have contributed to the elevated labor pressure exercise of older males.

- Decline of retiree medical health insurance: The fast rise in healthcare prices has been accompanied by a big decline in employer provision of retiree medical health insurance. This decline has dramatically modified the incentives going through older employees. In the event that they stick with their employer, they proceed to obtain medical health insurance; in the event that they depart earlier than 65, once they qualify for Medicare, they’re compelled to buy insurance coverage on their very own. Therefore, employees have a robust incentive to remain working till they qualify for Medicare.14

- Much less bodily demanding jobs: The character of employment has additionally modified dramatically for the reason that mid-Nineteen Eighties. As manufacturing has declined, the service sector has exploded with knowledge-based alternatives. Even inside manufacturing the character of jobs has modified, as corporations have automated and outsourced manufacturing and employed extra managers, engineers, and technicians. The brand new jobs put much less pressure on older our bodies.15

- Joint decision-making: The elevated share of married girls working means the choice to retire includes each spouses. Research counsel that husbands and wives wish to coordinate their retirement.16 Since wives on common are three years youthful than their husbands, in the event that they retire at age 62 (when first eligible to assert Social Safety), it will push husbands’ retirement age towards 65.17

- Non-pecuniary components: Older employees are usually among the many extra educated, the healthiest, and the wealthiest.18 Their wages are decrease than these earned by their youthful counterparts and decrease than their very own previous earnings. This sample suggests that cash is probably not the one motivator.

Because of these varied components, the workforce exercise of males has elevated considerably since 1990. The query is how this pattern interprets into modifications within the common retirement age.

The place Do We Go from Right here?

The query is whether or not the early drivers of delayed retirement – modifications to Social Safety, the shift from outlined profit to 401(ok) plans, the rise in academic attainment, enhancements in wholesome life expectancy, and the decline in retiree medical health insurance – will proceed to have a considerable influence resulting in will increase within the common retirement age going ahead.

Social Safety. All of the modifications within the Social Safety program are actually full. No additional changes have been made to the earnings take a look at. The rise within the FRA from 65 to 67 was steadily phased in, starting with these born in 1938 and ending at 67 with these born in 1960. These born in 1960 flip 65 this yr; thus, future cohorts will see no additional improve within the FRA.19 Lastly, the delayed retirement credit score – payable for many who declare advantages between the FRA and 70 – was additionally elevated steadily, from 3 p.c in 1983 to eight p.c in 2008. Therefore, future cohorts will see no additional improve on this incentive. Briefly, latest modifications to Social Safety should not have any impact on the common retirement age going ahead.

Pension Kind. The shift from outlined profit to 401(ok) plans is now full. Sure, some outlined profit plans live on within the public sector, however state and native employees account for less than about 10 p.c of the workforce and no main shift in pension kind is at present underway for this group.

Instructional Attainment. A lot of the acquire within the labor pressure participation of older people has been attributed to their elevated academic attainment.20 Certainly, for many of the twentieth century every technology of employees acquired extra training than the earlier one. In consequence, the share of males ages 50-54 with a university diploma elevated sharply. Nevertheless, within the mid-Nineteen Seventies the tempo of beneficial properties slowed, which meant that the share of males 50-54 with a university diploma stopped rising round 2000. Since then the share with a university diploma has declined and rebounded, however stays roughly on the 2000 degree. For girls, the development in academic attainment has continued – after a decade-long pause – however will doubtless degree off by 2030.21 The underside line is that academic beneficial properties are unlikely to be a significant driver of longer work lives going ahead.

Enhance in Wholesome Life Expectancy. Till 2005, the pattern of rising disability-free life expectancy prompt elevated capability for work, however latest research counsel this progress has stalled.22 Estimates of wholesome life expectancy at 50 – which mixes the incapacity charge with modifications in life expectancy – confirmed precise declines for lower-educated white employees and lower-educated Black males. Therefore, substantial will increase within the capacity to work longer is unlikely to maneuver the common retirement age in coming many years.

Decline in Retiree Well being Insurance coverage. As famous, the decline in employer-provided medical health insurance mixed with quickly rising healthcare prices has pushed employees to postpone retirement till they’re eligible for Medicare. This shift away from providing retiree well being advantages is nearly full. Lower than 20 p.c of enormous corporations – 200 or extra staff – supply retiree medical health insurance to present employees. Smaller corporations historically have not often supplied this profit.23 Thus, altering employer-provided well being advantages will now not present an rising incentive to work till 65.

The underside line is that the components contributing to the reversal within the labor pressure participation of older employees seem to have run their course. Their influence will stay, so it’s unlikely the common retirement age will decline. Then again, they may present little impetus for will increase within the common retirement age.24

Conclusion

After practically a century of decline, work exercise amongst older males stabilized within the Nineteen Eighties and commenced to extend within the Nineties. This turnaround mirrored modifications in Social Safety, retirement plans, and the character of labor, enhancements in academic attainment, the necessity to watch for Medicare protection, and numerous different components. In response, the common retirement age elevated by about three years.

You will need to put this three-year acquire in perspective. The typical retirement age continues to be decrease than it was when Medicare was enacted. And the foremost drivers for the beneficial properties up to now seem to have performed themselves out, making important future will increase within the common retirement age unlikely. Briefly, the beneficial properties up to now in working longer have been nice, however we in all probability have gone so far as we are able to go with out some new improvement to alter individuals’s incentives.

References

Blau, David M. and Ryan M. Goodstein. 2010. “Can Social Safety Clarify Tendencies in Labor Pressure Participation of Older Males in america?” Journal of Human Sources 45(2): 32-63.

Burtless, Gary. 2013. “The Influence of Inhabitants Growing old and Delayed Retirement on Workforce Productiveness.” Working Paper 2013-11. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Burtless, Gary and Joseph F. Quinn. 2002. “Is Working Longer the Reply for an Growing old Workforce?” Concern in Temporary 11. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Coile, Courtney. 2025. “Altering Retirement Incentives and Retirement within the US.” In Social Safety Applications and Retirement across the World: The Results of Reforms on Retirement Conduct, edited by Axel Borsch-Supan and Courtney Coile, 401-418. Chicago, IL: College of Chicago Press.

Coile, Courtney. 2021. “The Evolution of Retirement Incentives within the U.S.” In Social Safety Applications and Retirement across the World: Reforms and Retirement Incentives, edited by Axel Börsch-Supan and Courtney Coile, 435-459. Chicago, IL: College of Chicago Press.

Coile, Courtney. 2015. “Financial Determinants of Staff’ Retirement Selections.” Journal of Financial Surveys 29(4): 830-853.

Cosic, Damir and C. Eugene Steuerle. 2021. “The Impact on Early Claiming Profit Discount on Retirement Charges.” Working Paper 2021-1. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Costa, Dora L. 1998. The Evolution of Retirement: An American Financial Historical past, 1880-1990. Chicago, IL: College of Chicago Press.

Engelhardt, Gary V. and Anil Kumar. 2007. “The Repeal of the Retirement Earnings Take a look at and the Labor Provide of Older Males.” Working Paper 2007-1. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Friedberg, Leora. 2007. “The Latest Development In direction of Later Retirement.” Work Alternatives for Older People Sequence 9. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Friedberg, Leora and Anthony Webb. 2006. “Persistence in Labor Provide and the Response to the Social Safety Earnings Take a look at.” Working Paper 2006-27. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Friedberg, Leora and Anthony Webb. 2005. “Retirement and the Evolution of Pension Construction.” Journal of Human Sources 40(2): 281-308.

Gustman, Alan L. and Thomas Steinmeier. 2009. “How Adjustments in Social Safety Have an effect on Latest Retirement Tendencies.” Analysis on Growing old 31(2): 261-290.

Gustman, Alan and Thomas Steinmeier. 1994. “Employer-Supplied Well being Insurance coverage and Retirement Conduct.” Industrial and Labor Relations Evaluate 48(1): 124-140.

Johnson, Richard. 2004. “Tendencies in Job Calls for amongst Older Staff, 1992-2009.” Month-to-month Labor Evaluate 127(7): 48-56.

Kaiser Household Basis. Employer Well being Advantages Survey, 2021. San Francisco, CA.

Karoly, L. A. and J. A. Rogowski. 1994. “The Impact of Entry to Postretirement Well being Insurance coverage on the Choice to Retire Early.” Industrial and Labor Relations Evaluate 48(1): 103-123.

Kopczuk, Wojciech and Jae Track. 2008. “Stylized Details and Incentive Results Associated to Claiming of Retirement Advantages Primarily based on Social Safety Administration Information.” Working Paper WP-2008-200. Ann Arbor, MI: College of Michigan Retirement Analysis Middle.

Lahey, Karen E., Doseong Kim, and Melinda L. Newman. 2006. “Full Retirement? An Examination of Elements That Affect the Choice to Return to Work.” Monetary Providers Evaluate 15(1): 1-19.

Maestas, Nicole. 2005. “Again to Work: Expectations and Realizations of Work after Retirement.” Working Paper WR-196-1. Santa Monica, CA: RAND.

Margo, Robert A. 1993. “The Labor Pressure Participation of Older People in 1900: Additional Outcomes.” Explorations in Financial Historical past 30(3): 409-423.

Mastrobuoni, Giovanni. 2009. “Labor Provide Results of the Latest Social Safety Profit Cuts: Empirical Estimates Utilizing Cohort Discontinuities.” Journal of Public Economics 93(11): 1224-1233.

Michaud, Pierre-Carl, Arthur van Soest, and Luc Bissonnette. 2018. “Understanding Joint Retirement.” Working Paper 25030. Cambridge, MA: Nationwide Bureau of Financial Analysis.

Moen, Jon R. 1987. “Essays on the Labor Pressure and Labor Pressure Participation Charges: The US from 1860 by way of 1950.” Ph.D. Dissertation. Chicago, IL: College of Chicago.

Monk, Courtney and Alicia H. Munnell. 2009. “The Implications of Declining Retiree Well being Insurance coverage.” Working Paper 2009-15. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Munnell, Alicia H. 2022. “Tips on how to Suppose About Latest Tendencies within the Common Retirement Age.” Concern in Temporary 22-11. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Munnell, Alicia H., Kevin E. Cahill, and Natalia Jivan. 2003. “How Has the Shift to 401(ok)s Affected the Retirement Age?” Concern in Temporary 13. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Munnell, Alicia H. and Steven A. Sass. 2008. Working Longer: The Resolution to the Retirement Earnings Problem. Washington, DC: Brookings Establishment Press.

Quinby, Laura D. and Gal Wettstein. 2021. “Are Older Staff Able to Working Longer?” Working Paper 2021-8. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Ruggles, Steven, J. Trent Alexander, Katie Genadek, Ronald Goeken, Matthew B. Schroeder, and Matthew Sobek. 2010. Built-in Public Use Microdata Sequence: Model 5.0 [Machine-readable database]. Minneapolis, MN: College of Minnesota.

Rust, John and Christopher Phelan. 1997. “How Social Safety and Medicare Have an effect on Retirement Conduct in a World of Incomplete Markets.” Econometrica 65(4): 781-831.

Rutledge, Matthew S., Christopher M. Gillis, and Anthony Webb. 2015. “Will the Common Retirement Age Proceed to Enhance?” Working Paper 2015-16. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Sass, Steven A. 1997. The Promise of Personal Pensions: The First Hundred Years. Cambridge, MA: Harvard College Press.

Schirle, Tammy. 2007. “Why Have the Labour Pressure Participation Charges of Older Males Elevated for the reason that Mid-Nineties?” Working Paper. Waterloo, ON: Wilfrid Laurier College, Division of Economics.

Track, Jae and Joyce Manchester. 2007. “Have Individuals Delayed Claiming Retirement Advantages? Responses to Adjustments in Social Safety Guidelines.” Social Safety Bulletin 67(2): 1-23.

Thane, Pat. 2000. Previous Age in English Historical past: Previous Experiences, Current Points. Oxford, UK: Oxford College Press.

U.S. Census Bureau. Present Inhabitants Survey, 1962-2024. Washington, DC: U.S. Authorities Printing Workplace.

U.S. Social Safety Administration. 2024. The 2024 Annual Report of the Board of Trustees of the Federal Previous-Age and Survivors Insurance coverage and Federal Incapacity Insurance coverage Belief Funds. Washington, DC: U.S. Authorities Printing Workplace.